Spring is busting out all over up here in Lincolnshire, spurred on by the lovely weather recently. The swallows are back in the barn, always good to see that they made it back from South Africa (where the RSPB tells me British swallows over-winter). The trees and flowers are all blooming, not quite yet into the Bluebell season yet, but plenty of colour…

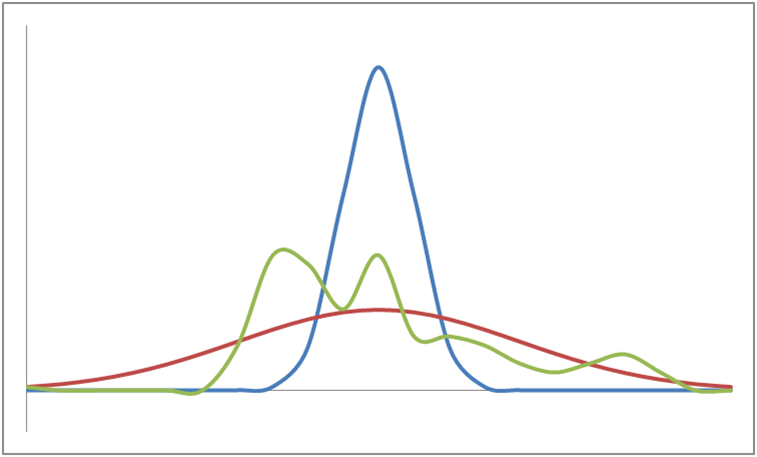

Whilst enjoying the sunshine and in the full flush of the other joys of Spring, one of the topics on my mind recently recently has been Service Integration, an important ingredient for delivering excellent IT services. The nub of the issue that Service Integration looks to solve is like this:

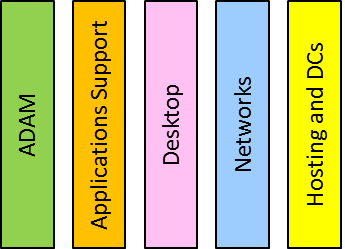

In recent years, the trend for contracting IT Services has been to push beyond the big-bang mega-deals of old to selective outsourcing of like groups of IT services , dubbed “towers” by industry pundits such as Gartner and their ilk, thus:

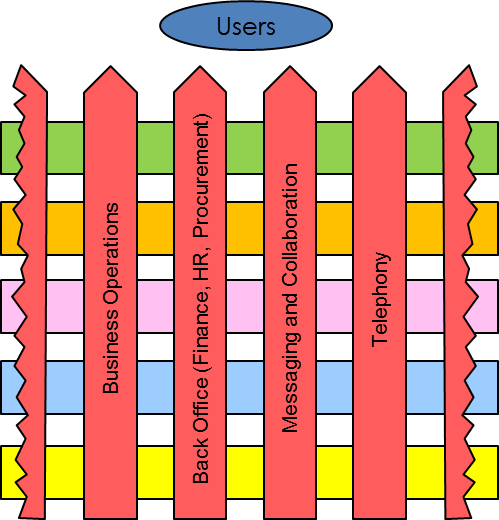

However, user services are often a combination of pieces from each tower, so to make users happy, avoid incident “ping-pong” and other good things, services really need to be managed in a joined-up way, orthogonally to the towers, like this

This glues, or integrates, if you like, the different elements of a complete service, hence, this joining-up is “Service Integration”

You could abbreviate Service Integration to SI, but this is ripe for confusion with the older usage of SI, as Systems Integration, all about gluing together bits of software and hardware to make new systems, i.e., Building systems rather Running services.

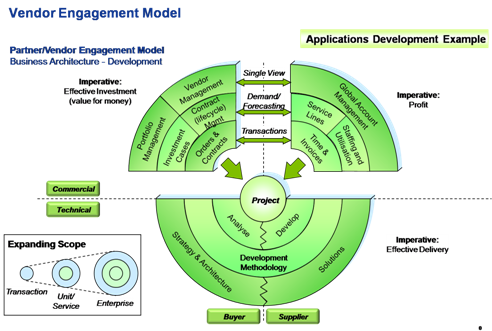

There have been a number of landmark deals espousing the Service Integration model , from ABN/AMRO and the “Guardian” model back on 2005, through to the most recent state if the art at National Grid with the recently penned deal with HP ( Computing article on National Grid / HP SMI deal and HP Press Release).

One of the usual suspects in building such a model, is dear old ITIL, now ISO/IEC20000

Not to be confused with Tyltyl and Mytyl, characters from Maeterlink’s Blue Bird, a well-known childrens’ classic

ITIL is a worthy model and has been around for many years since penned by the CCTA, and is now at version 3,. Version 3 is quite good, as it has finally acknowledged that services have a life-cycle, and gosh, this sort of stuff is iterative (what a buzz). V1 and V2 in contrast had rather static views of the world)

I was astonished recently in one of those rare, but memorable, jaw-dropping, goggle-eyed moments when a sales guy from some other organisation opined in a meeting (to paraphrase) “Why all this fuss about V3, there’s some really good stuff in V2”. Everybody in the room looked at the poor unfortunate in deadly silence as he swallowed his foot and half his leg up to the knee and lower thigh, and from that moment he became nobody, a nebbish, a zero. Ouch!

Nebbish – a Yiddish word meaning “an insignificant, pitiful person; a nonentity”, very effectively characterised in a book I once read but can no longer recall the title so cannot name-check or credit the author (sorry), as a person who when they walk into a room is like someone just walked out

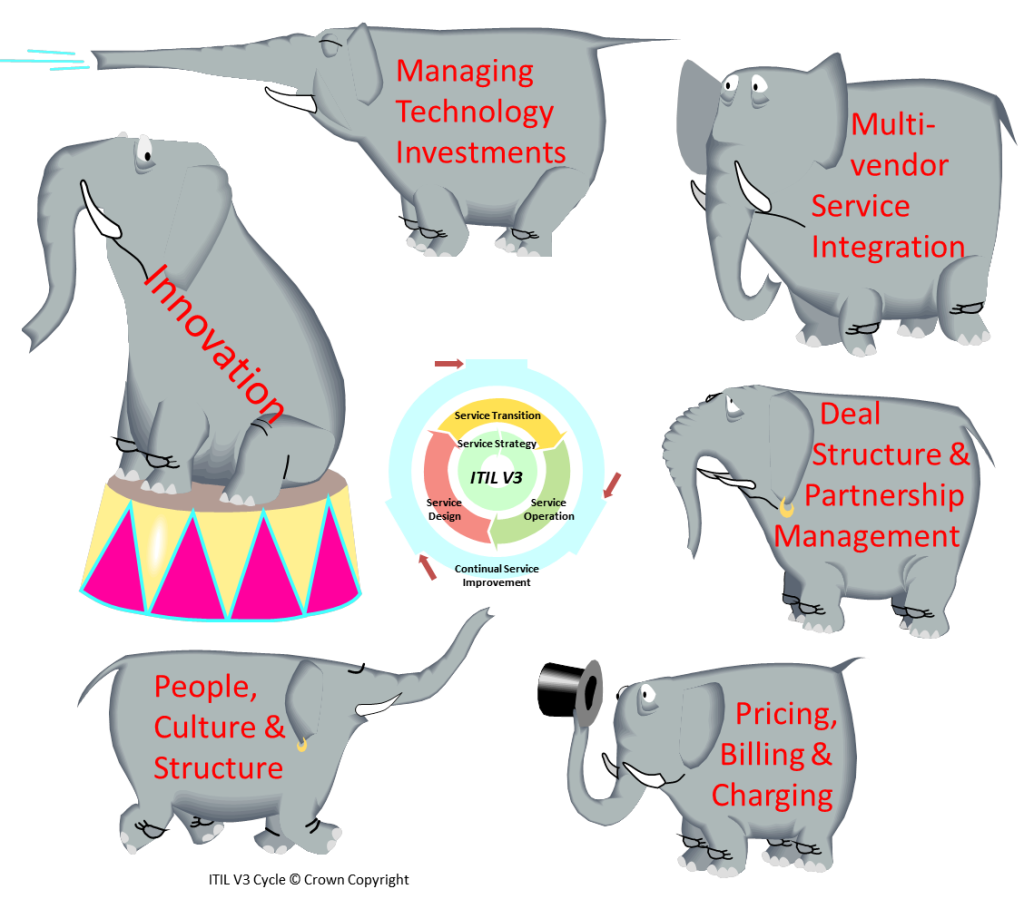

ITIL V3 was published in 2007, but only just really made it into the 21st century with its iterative, nay, agile, flavouring, yet there are a number of “elephants in the room”, major topics not covered that are essential components in the full business architecture of modern IT service delivery…

Not just a few elephants, but a thundering herd in fact, in the form of (not exhaustively):

- Innovation

- Managing Technology investments

- Multi-vendor service integration

- Deal Structure and Partnership Management

- Pricing, Billing & Charging

- People, Culture & Structure (at least 3 elephants, in just this line alone.)

COBIT makes a much broader sweep in its attempt to embrace the whole entity that is a living, breathing IT organisation and seems to fill many of the gaps not covered by ITIL.

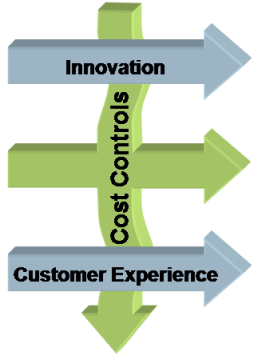

Yes, I know I bang on about Innovation quite a bit in these posts, but it is a common current complaint I hear that innovation has been squeezed out in deals struck in the 2000s, and now the demand is to find ways to enable it again, even to the extent of considering to pay an Innovation “premium”.

COBIT, founded in GRC, and providing an excellent check-list with which to herd most of the elephants, is as blind as ITIL when it comes to Innovation. If you search through the text of the COBIT 4.1 framework definition doc, you will find the word “innovation” writ not once at all in its 197 pages!

GRC = Governance, Risk Management & Compliance, in case you wanted to know

Risk management is as central to innovation and agility as it is to the philosophy of COBIT with its focus on control. Yet there is a classic schism between the COBIT GRC-based shibboleths and the ways of innovation and agility, and one might cynically draw the conclusion that COBIT is about stopping things getting done, whereas innovation and agility are the polar opposite – “skunkworks” innovation is the antithesis of the GRC mindset, even anathema. And, of course, COBIT is process-oriented, just like ITIL. Good, but rather 1990s Hammer & Champy and still further to go to get into the 21st century.

The COBIT 4.1 Executive Summary contains a hugely contentious and flawed.headline on page 13 vide “PROCESSES NEED CONTROLS”. To justify this you need to follow this syllogism:

- Processes are risks

- Risk need controls

- Therefore, Processes need controls

(yes, this is, indeed, nonsense)This does not compute, the base premise is wrong: Yes, High risks, whether processes or otherwise do need controls, but don’t waste time putting controls on low risk processes.

“Quick, evacuate the building, we’ve had a slightly embarrassing failure to detect a root cause in Problem Management”

Also, processes can be controls, so do we add meta-control processes to control the control processes? – Quis custodiet ipsos custodes ad nauseam.

You may think that I am being rather harsh on the solid works of people who have created ITIL, COBIT et al. These frameworks are all useful check-lists of best practice, but need to be used with some care, lest the medicine kill the patient. And they help with the standardisation of service descriptions when making like-for-like comparison somewhat easier in the sourcing and procurement process. However, they are inevitably behind the leading edge. for example, getting joined-up in the customer experience dimension (orthogonal to both towers and process orientation) is yet another step to go.

On the other hand, getting up the curve to build Innovation into modern IT service deals, well, that can be done right now (give me a call!)